Fundamental takeaways:

- Bitcoin leads the outflow of the crypto market, in response to Coinshares’ newest weekly report.

- The worth of BTC has been going up as a result of buyers are taking part in it secure.

Learn CoinChapter.com on google information

NEW DELHI (CoinChapter.com) — Cryptocurrency funding merchandise proceed to bleed, with Bitcoin (BTC) main the outflows within the week ending Could 19, in response to Coinshares’ newest weekly digital asset flows report.

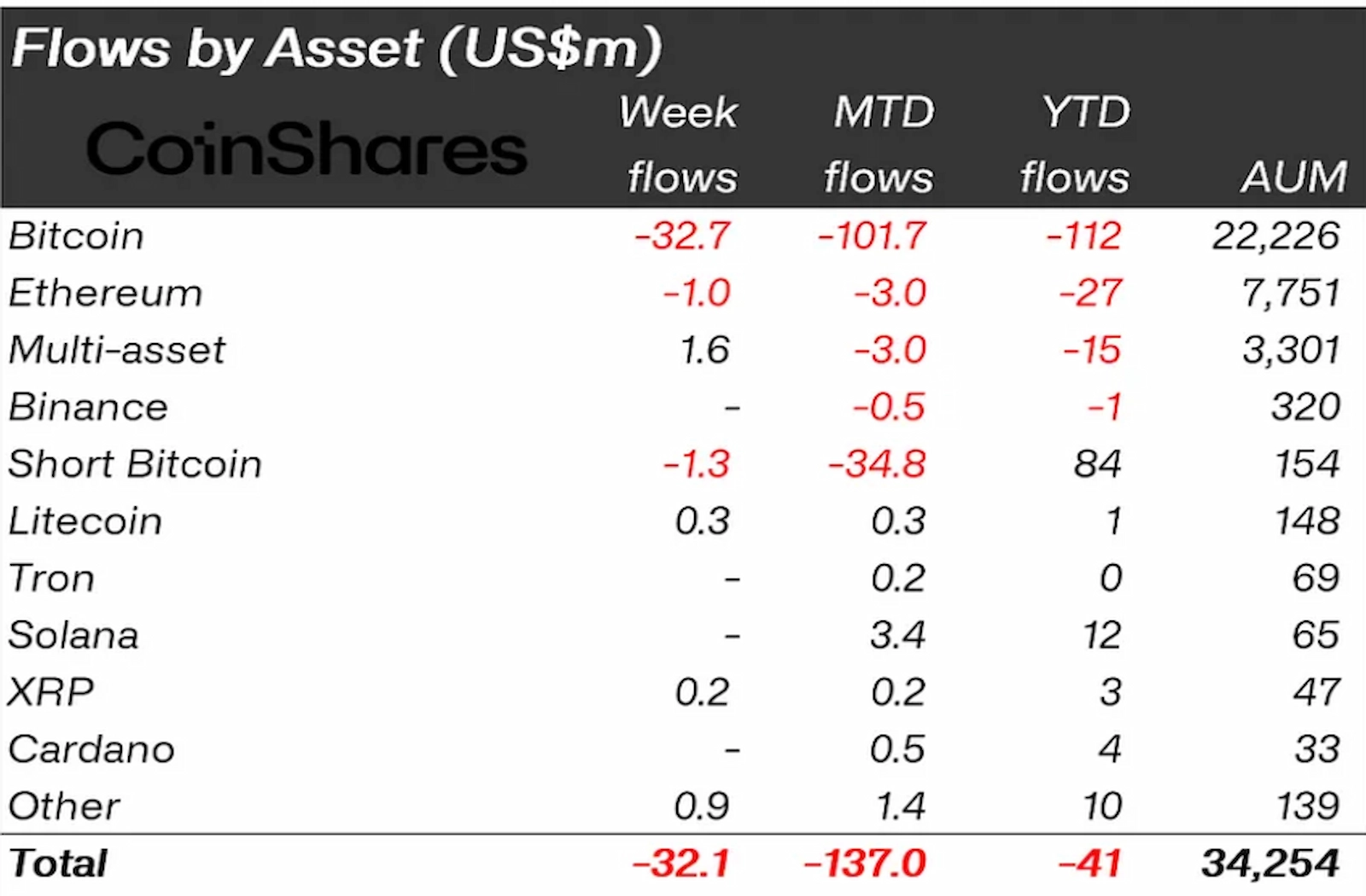

Total, digital asset funding merchandise noticed an outflow of $32.1 million, principally as a result of dangerous sentiment in direction of BTC. Coinshares crypto analyst James Butterfill famous that the outflows within the week ending Could 19 represented the fifth straight week of outflows.

Over the previous 5 weeks, digital asset funding merchandise have skilled an outflow of $232 million. Moreover, Butterfill famous that quantity on the trusted trade fell to $20 billion, its lowest degree since late 2020.

Bitcoin outflows totaled $32.7 million within the week, with quick Bitcoin funds a distant second with $1.3 million outflow. The second largest cryptocurrency by market cap, Ethereum, additionally noticed an outflow of $1 million.

Additionally Learn: BEN Value Surges 100% as BitBoy Confirms “The Deal”

Nevertheless, different altcoins noticed minor inflows, led by Avalanche ($0.7 million), adopted by Litecoin with $0.3 million inflows. The launch of the LTC-20 Litecoin appears to assist safe inflows for altcoins.

Bitcoin buyers appear to be ready for a possible set off that can trigger the worth of BTC to rise or fall. Consequently, the token worth has been creeping up currently. For instance, the upcoming Federal Reserve rate of interest resolution in June is perhaps the catalyst for the worth of BTC.

Moreover, the diminished hype from the memecoin craze might have sucked the volatility out of the Bitcoin worth.

BTC Struggles To Flip Resistance Instantly

In the meantime, the bulls sustained BTC’s Could 2023 worth downtrend above the 100-day EMA (blue wave) dynamic assist degree close to $26,230. Nevertheless, BTC worth was up 3.5% since its Could 22 low of $26,547 to hitting a Could 23 every day excessive close to $27,478 earlier than bears trimmed beneficial properties.

The bears are aggressively holding onto the 50 day EMA (purple wave) resistance close to $27,500. A break above the EMA resistance degree might lead to BTC worth rising to a resistance degree close to $28,760. Furthermore, a sustained rally might assist Bitcoin’s worth goal resistance close to $30,640 earlier than pulling again.

Nevertheless, a bearish break of the continued consolidation might lead to BTC worth dropping to 100 day EMA assist close to $26,230. A break of the speedy assist degree would possibly pressure Bitcoin worth to check the 200-day EMA (inexperienced wave) assist close to $25,000 earlier than recovering.

The relative energy index for BTC stays impartial, coming in at 47.18 on the every day chart.

Bitcoin Funds Publish Leads Weekly Outflows As BTC Value Struggles To Overcome $27.5K Resistance appeared first on CoinChapter.