Learn CoinChapter.com on google information

Predominant takeaways:

- Fantom token FTM is 90% draw back threat, based on technicals.

- On-chain metrics help prognosys, with declining TVL and market dominance.

- Can Uniswap deployment save dormant Fantom?

YEREVAN (CoinChapter.com) – FTM token Fantom soared 240% in January 2023. Nonetheless, the rally fizzled out, and the coin is down 50% since then, buying and selling at $0.33 on Might 24, 90% beneath its 2021 file excessive. Furthermore, bearish technicals threaten an extra 90% decline, chopping FTM costs near zero.

FTM in a descending triangle

After peaking on February 1, the Fantom token fashioned a technical sample known as the ‘descending triangle’. The latter requires a flat help line stopping sharp declines and falling resistance limiting upward makes an attempt.

Notably, the sample predicts a decline equal to the utmost triangle top, concentrating on a near-zero FTM worth, a 90% drop for the token.

On Might 24, the Fantom token reached an necessary help/resistance degree, related since Might 2022. Nonetheless, lowered buying and selling volumes and detrimental MACD sentiment help the bearish forecast, together with on-chain metrics.

Fantom’s on-chain metrics are additionally bearish

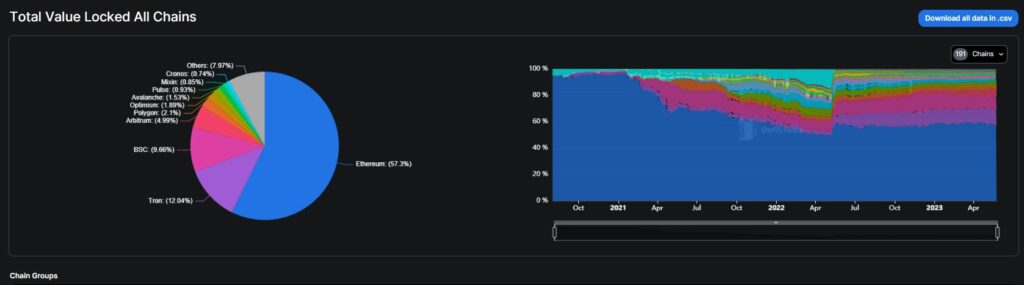

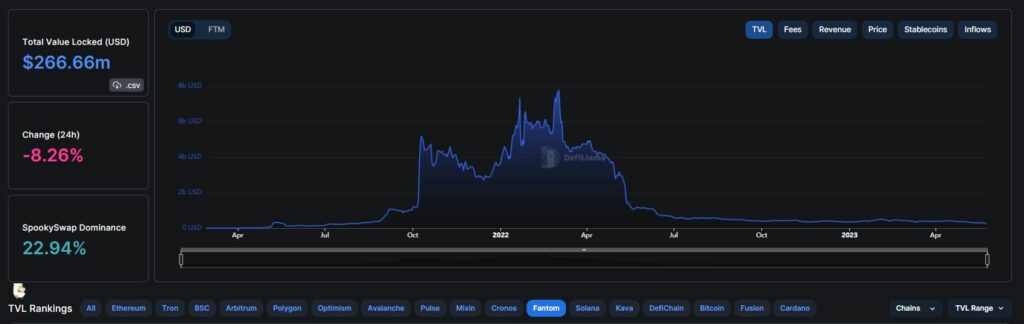

In line with knowledge from DeFi monitoring platform DeFiLlama, Fantom Community held 2.51% market dominance in January 2022. Nonetheless, the dominance progressively decreased and solely stayed at 0.62 in Might 2023, regardless of the spike in January FTM costs.

The platform’s whole locked worth (TVL) additionally plunged after its 2022 excessive and stood at $266 million on the time of writing, after an 8% day by day decline.

In line with on-chain analytics platform Santimenr, the autumn in FTM costs has additionally been accompanied by lowered USD transaction volumes on the platform, and low social dominance.

Will Uniswap migrate to Fantom?

Considered one of Columbia College’s know-how items devoted to blockchain, nicknamed “Blockchain@Columbia,” submitted a proposal to use Uniswap, one of many largest decentralized exchanges, to the Fantom blockchain.

Notably, the proposition comes after Uniswap’s Enterprise Sourcing License (BSL) expired on April 1, shifting the venture to a Normal Public License. In the meantime, expiration additionally provides builders the liberty to fork Uniswap V3.

With the tip of BSL’s Uniswap v3, different DEXs together with Beethoven X, are eyeing alternatives to seize market share on the Fantom community. To remain forward of the competitors, Uniswap should set up its presence on Fantom rapidly and effectively.

learn proposals.

Specialists at Columbia emphasize the usefulness of the Fantom framework and consensus, which pave the best way for sooner transactions. Axelar, a cross-chain bridge platform connecting a number of blockchain networks, will act because the bridge infrastructure supplier.

Additionally learn: Solana Integrates ChatGPT Plugin — SOL Worth Mum.

The proposal might revive the dormant Fantom platform, if Uniswap goes forward. Nonetheless, as of Might 24, the alternate has but to launch an official stance on the proposition.

Pos Phantom (FTM) Danger Drops to Zero – Can Uniswap Save the Day? first appeared on CoinChapter.